What is an e-Insurance account?

According to the IRDAI (Insurance Regulatory and Development Authority of India) “e-Insurance account is the portfolio of insurance policies of a policyholder held in an electronic form with an insurance repository.”

Hitherto insurance policies were made available in physical mode only. eIA allows for purchase of insurance in dematerialized or demat form.

Which insurance policies require an e-Insurance account?

|

Type of insurance

|

Sum Insured (equal to or exceeding) (in Rs.)

|

Single/Annual Premium

(equal to or exceeding) |

|

Pure term (excluding term with ROP*)

|

10,00,000/-

|

10,000/-

|

|

Other than Pure term (including term with ROP*)

|

1,00,000/-

|

10,000/-

|

|

Pension policies

|

NA

|

10,000/-

|

|

Immediate Annuities

(Pension p.a.) |

NA

|

10,000/-

|

|

All retail General Insurance policies except Motor

|

10,00,000/-

|

5,000/-

|

|

Individual Health

|

5,00,000/-

|

10,000/-

|

|

Motor Retail

|

All policies

|

All policies

|

|

Individual Personal Accident & Domestic Travel

|

10,00,000/-

|

5,000/-

|

|

Individual Travel Insurance (Overseas)

|

All policies

|

|

* ROP (Return of premium life insurance) is a type of term life insurance policy that returns the premiums paid for coverage if the insured party survives the policy’s term.

How to open an e-Insurance account?

You need to choose one of the five authorized insurance repository which are authorized by IRDAI to for maintaining data of insurance policies in electronic form on behalf of Insurers. You can buy and keep all your policies with any one of the following repository. Before selecting your repository do not forget to contact your insurance provider to check if they have already partnered with a particular repository.

1. NSDL Database Management Limited

2. Central Insurance Repository Limited

3. SHCIL Projects Limited

4. Karvy Insurance Repository Limited

5. CAMS Repository Services Limited

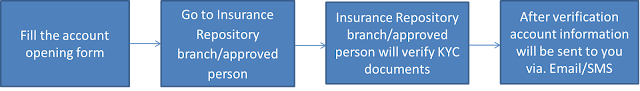

You need to download/fill the account opening form from the website of the repository or the insurer. The filled form should then be submitted along with a photo ID, recent passport size photograph, cancelled cheque ( In case of ECS/NEFT services for insurance premium payment transaction) and address proof to the office of Insurance Repository or insurance company or authorized Approved Person** (AP) appointed by Insurance Repository (IR).

** An Approved Person is a Point of Sale (PoS) appointed by Insurance Repository and will be working on behalf of Insurance Repository to extend the IR services.

The AP/insurer will verify the KYC documents and process the application. Post that the Insurance Repository will open the account and send the ID and password via text and e-mail to you.

One thing to note is that you do not have to pay in order to create and operate an e-Insurance account. It is provided free of charge. Another important rule is that you can only open one e-Insurance account at a time, you cannot have multiple e-Insurance accounts.

You can download this file available on the IRDAI website in case you have more questions.