The file has 3 main sections:

1. The data entry section:

This is where you enter the loan details including the loan amount, interest payable, tax slab (10%, 20% or 30%) that you fall in and the loan start date.

2. The calculations:

In this section you will find a month wise breakup of the interest and principal that would form that month’s EMI. You can enter the amount you would prepay in a particular month and the calculations will change accordingly.

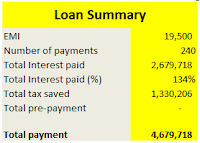

3. The loan summary:

In this section you will find the loan details including the total interest paid, tax savings if any (I have assumed that you would save up to Rs. 1.5 Lakhs under section 80C and up to Rs. 2 Lakhs under section 24 of the Income Tax Act.

In the example given above you see that that a Rs. 20 Lakhs loan for a 20 year period will result in an EMI of Rs. 19,500. You will have to pay an interest of around Rs. 26 Lakhs over the 20 year period and can save around Rs. 13 Lakhs assuming that the current incentives on offer by the Income Tax department will continue into the future.

The most important thing that the file helps you with is that you can figure out what you can save in interest if you prepay your loan. Prepaying also doesn’t mean that you are getting rid of the whole loan amount at one go. Most of the times that won’t be the case (unless you have windfall gains). It just means that you are reducing your liability, one step at a time.

If you see section 2 of the excel file you will notice that the initial years of paying EMI goes towards paying the interest amount. That’s why for first 2 to 3 years, the payment towards your principal may just be a couple of thousands while you have paid couple of lakhs in EMI.

What does that mean? The earlier you prepay in the tenure the more you save on the interest. Prepaying in the latter part of your tenure actually doesn’t save much. (Refer to the calculations in the excel sheet).

In conclusion

This excel sheet gives you an indication of the financial implications of prepaying your home loan. Do not forget that you will need to ensure that you have the required liquidity to meet any other financial commitments before you decide to prepay your loan. Lastly, I have used a number of assumptions in the home loan prepayment calculator. So do take advise of your chartered accountant prior to taking action on the data contained in file.

You can download the calculator here.

—

I found an interesting book “Buy a house without a home loan”. It is an interesting read. Take a look for yourselves.

Wisconsin Mortgage Corporation has been providing quality home loans across Wisconsin.Meet our loan officers. Please choose the loan officer that you were referred to view their personal page and apply online.Best Wisconsin Mortgage BrokerEach loan officer's page includes the following services.