As India has started its journey towards a cashlite/cashless economy, traveling down the road of demonetization we are finding newer apps and technologies rolled at an increasing pace. There are numerous options trying to meet the need of a diverse set of people differing in their access to internet, economic status, purchasing power (deciding use of smart phone) accessibility to technology etc.

Recently we saw a stellar launch of an application by our honorable prime minister. The app is called BHIM (Bharat Interface for Money) and is dedicated to and named after Babasaheb Dr. Bhimrao Ambedkar.

It is already topping the charts in Google store and has been downloaded almost 5 million times at the time of writing this post.

What is BHIM (Bharat Interface for Money)?

BHIM is a Unified Payments Interface (UPI) based app rolled out by National Payments Corporation of India (NPCI) to address the gap between those having UPI, wanting to transact freely with anyone. It includes all the security features of UPI (such as having a virtual payment address or VPA and hence securing your bank details) while giving freedom to transact with anyone having a bank account and an attached mobile number.

Security features of BHIM

BHIM provides layered security to its users making it transactions highly secure.At the time of download and opening the app for the first time, the app gets bound to the mobile device ID and to the phone number.Only the registered numbers attached to bank accounts can be used to operate the app. The UPI PIN set by the user is required every time a transaction is to be carried out using the BHIM app.And then in the end the app itself can be protected by a password required to open it for use.All these features ensures that even if your mobile is stolen the app cannot be used to make unauthorized transactions.

How is BHIM different from other UPI based apps?

BHIM uses UPI in the back end. However there are a number of key differences with the other UPI based apps. You have to download the UPI app of the bank where you have an account, whereas with BHIM you can add any bank account (which are of course member participants), but only one account can be added at a time and in case you wish to change the account through which you want to transact, you will have to replace the earlier one. Also if more than one account are attached to the same mobile number then only one account can be accessed as mentioned earlier. With BHIM, you can send and receive money to and from any non UPI account or addressee (all they need to have an account in bank with phone number attached to the account; in this case you may need IFSC (Indian Financial System Code) or MMID (Mobile Money Identifier) code to make the transaction). A facility of scanning QR code and making payment is also available with the app.

How is BHIM different from a mobile wallet like PayTm?

Unlike a mobile wallet where you have to load money in an external wallet BHIM does away completely with that part while at the same time securing your details (as the other party sees only the VPA). While in a mobile wallet the recipient or the other party too should be enrolled with same wallet to transact BHIM does not require that, i.e. it surpasses mobile wallets when it comes to interoperability.

What are the transaction limits set by BHIM app?

A maximum of Rs 10,000 can be shared per transaction, and a total of Rs 20,000 can be sent within 24 hours.

The list of banks that are a part of this initiative is given below.

– Allahabad Bank

– Andhra Bank

– Axis Bank

– Bank of Baroda

– Bank of India

– Bank of Maharashtra

– Canara Bank

– Catholic Syrian Bank

– Central Bank of India

– DCB Bank

– Dena Bank

– Federal Bank

– HDFC Bank

– ICICI Bank

– IDBI Bank

– IDFC Bank

– Indian Bank

– Indian Overseas Bank

– IndusInd Bank

– Karnataka Bank

– Karur Vysya Bank

– Kotak Mahindra Bank

– Oriental Bank of Commerce

– Punjab National Bank

– RBL Bank

– South Indian Bank

– Standard Chartered Bank

– State Bank of India

– Syndicate Bank

– TJSB

– UCO Bank

– Union Bank of India

– United Bank of India

– Vijaya Bank

– Yes Bank Ltd

So how do you start using BHIM?

Step 1- Go to google store and download BHIM here. (beware of fake apps pretending to be BHIM).

Presently it is available only for Android users.

Step 2- Open the App and choose language (presently available in English and Hindi)

Step 3- Provide the app permission to read SMSes on your phone and to verify your phone with UPI.

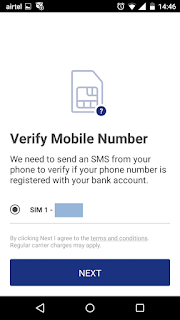

Step 4 – In case you have a dual SIM phone, decide which phone number you want to use with the BHIM app. Keep in mind that in order to use the phone number, it must be registered with your bank account.

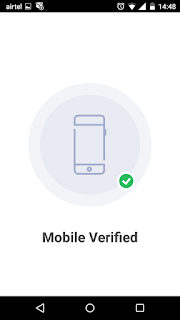

Step 5 – Once your mobile number is verified decide a passcode for your BHIM app.

Step 6 – Decide which bank you want to use.

Step 7 – You will be shown the accounts which have been linked to your phone number. Select the one that you want to use. You are now ready to begin transact.

Step 8 – In order to send money to another account, click on Send and enter the VPA.

Step 9 – Once the VPS is verified, you will be asked to enter the amount to be transferred.

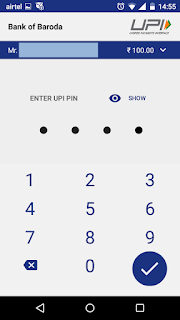

Step 10 – You will be asked to enter your UPI PIN for the transaction to go through. Once successful, you will be notified accordingly.

Hi, what is a UPI PIN and How do you get it

Hello. A UPI PIN is required for you in order to complete any transaction. You can create a UPI PIN by entering your debit card details in the BHIM app.