NPS stands for National Pension System. A voluntary contribution scheme(Central Government employees who joined after 1 January 2004 need to compulsorily invest in NPS since they will no longer get defined benefit pensions on retirement) regulated by the PFRDA, it aims to provide retirement income to all Indian citizens that invest in it through safe and reasonable market based returns.

What is a Tier 2 NPS account?

National Pension System (NPS) has two types of accounts – Tier 1 and Tier 2.

You need to open a Tier I account in case you want to invest in NPS. You will be assigned a Permanent Retirement Account Number (PRAN) once your NPS account is opened. Keep in mind that you cannot withdraw the amount that you have invested in a Tier 1 account until maturity (except in certain cases).

In comparison a Tier 2 account allows you to withdraw your money as and when you want. So a Tier 2 account operates more or less like a mutual fund with much lower fund management and other charges. According to an Economic times article, “The fund management charges of NPS Tier II plans are barely 1% of the cost of the average direct plan. A direct mutual fund charges 0.75-1.5%—or Rs 750-1,500 per year for managing an investment of Rs 1 lakh, compared with Rs 1,500-2,500 charged by a regular mutual fund. But NPS Tier II plans charge only 0.01%—or Rs 10 per year for managing an investment of Rs 1 lakh.”

So should you invest in a Tier 2 NPS account?

There are a number of factors that need to be considered while deciding to invest in a Tier 2 account.

You need to have a Tier 1 NPS account in order to open a Tier 2 account. In other words only if you have a live Tier 1 account can you apply for a Tier 2 account.

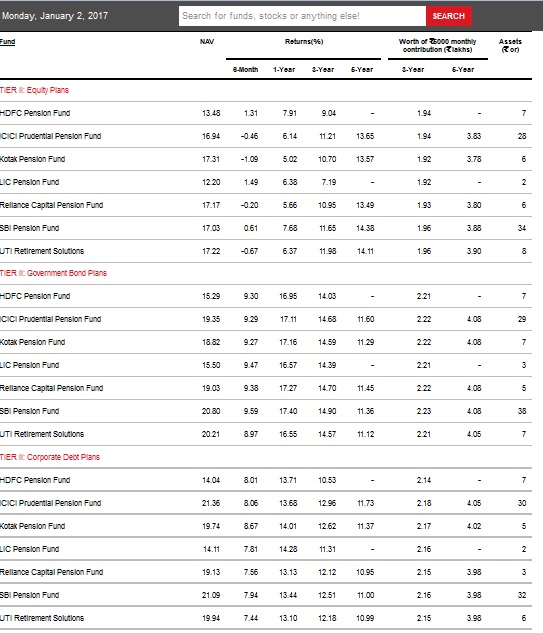

According to Economic Times, NPS Tier II plans have outperformed mutual funds of the same vintage by 70-200 basis points (.7%-2%) across different time frames. I am attaching an image which shows the returns generated by the funds under the NPS Tier 2 option.

Source: https://www.valueresearchonline.com/nps

You can also take a look at http://vro.in/nps for up-to-date returns of all NPS funds. In fact, according to the Economic Times article,NPS has outperformed PF, in the last six months you would have earned more than what the Provident Fund offers in a full year.

Tier 2 does not offer the tax benefits provided by an NPS Tier 1 account (Rs.1,50,000 as per section 80CCD(1) and Rs.50,000 as per section 80CCD(1b)). In addition, there is still some ambiguity on how the maturity proceeds are taxed for a NPS Tier 2 account. For instance, some believe that even the long-term gains (LTG) from equity funds may get taxed and debt fund investments may not be eligible for indexation benefit. Other believe that the proceeds would be taxed according to your tax bracket.

The fund management charges NPS Tier II plans are barely 1% of the cost of the average direct plan resulting in better returns.

So I think that a Tier NPS 2 account is a good savings and investment option if you are looking for an instrument which is a medium-term investment tool, notwithstanding the taxation ambiguity.

How can you open a Tier 2 NPS account online?

So how can I open a NPS Tier 2 account online? The process is quite simple if you have a live Tier 1 account.

Step 1: Go to the eNPS site: https://enps.nsdl.com/eNPS/NationalPensionSystem.html and click on Tier II Activation.

Step2: You will be asked to click on a button to receive a one time password (OTP) on your registered mobile number. Enter the OTP you receive.

Step3: Verify your details

Step 4: Once the complete registration details are provided, you will be required to pay initial contribution through Payment Gateway Service Provider (PGSP). You will be routed to the Bank portal (Internet Banking portal) for initial payment.

Step 5: Print and courier your form to the NSDL office at the following address:

Central Recordkeeping Agency (eNPS)

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower,

Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

Select ‘Print & Courier’ option in the eSign / Print & Courier page. You need to take a printout of the form, paste your photograph (please do not sign across the photograph) & affix signature.

The finer details

You need to invest a minimum of Rs. 1000 at the time of opening a Tier 2 NPS account. You need to maintain a minimum balance of Rs. 2000 at any time in a Tier 2 account.

Thanks for sharing informative post. Keep Posting.