Did you deposit your old 500 and 1000 rupee notes during demonetization? The Income Tax Department (ITD) has used big data analytics to compare of demonetisation data with information in ITD databases to identify taxpayers wherein the cash transactions do not appear to be in line with the taxpayer’s profile. ITD has enabled online verification of these transactions in order to explain the mismatch. Here are the steps you need to e-verify the cash deposits made post the note ban.

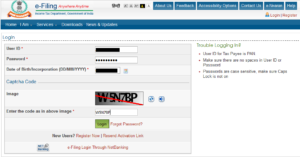

Step 1: Login to your account at https://incometaxindiaefiling.gov.in

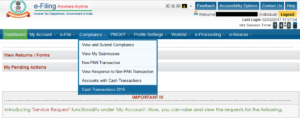

Step 2: Click on ‘Compliance’ …. ‘Cash Transactions 2016’

Step 3: The details of transactions related to cash deposits you have made during 9th Nov to 30th Dec 2016 will be displayed. This data will be shown only if the deposits do not appear to be in line with the taxpayer profile.

Step 4: Confirm if the bank details displayed relate to your PAN.

Step 5: If yes, you need to provide explanation of the transaction.

You can find more details of the process by clicking on ‘Help’ once you have logged in and clicking on ‘User Guide for cash transactions made during 9th Nov to 30th Dec 2016′.