What is TDS?

TDS stands for Tax deducted at source. According to the Income Tax Department guidelines, a person or an organization that makes payments such as salary, commission, professional fees, interest, etc. needs to deduct a certain percentage of tax on behalf of the IT department before making payment in full. Now let us understand this concept with an example assuming that a company is paying salary to an employee and deducts TDS as per law. Let’s assume that ABC Ltd pays Rs. 40,000/- per month to an employee who falls in the 10% income tax bracket. So ABC Ltd. will deduct a tax of Rs. 4,000/- and make a net payment of Rs. 36,000/- to the employee. The amount of 4,000/- deducted by ABC Ltd will be deposited with the IT department.

So how can you check if the TDS deducted by your employer is actually going to the government?

You will need two documents in order to do so. Your salary slip and Form 26AS. The tax deduction in the salary slip should match the data in your Form 26AS.

Form 26AS is the annual statement in which the details of tax credits are maintained for each taxpayer as per the database of Income-tax Department.

Form 26AS contains details of:

- Tax deducted by deductors on behalf of Tax Payer

- Tax collected by collectors on behalf of Tax Payer

- Advance / Self-Assessment tax deposited by Tax Payer

- Refund paid by ITD to Tax Payer

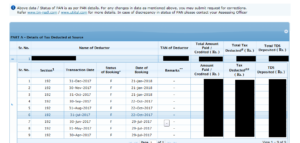

Part A of the Form 26AS helps you view of all financial transactions involving TDS during the relevant year at one place.

You can view Form 26AS online using two methods.

1. View your Form 26AS online from the income tax filing website

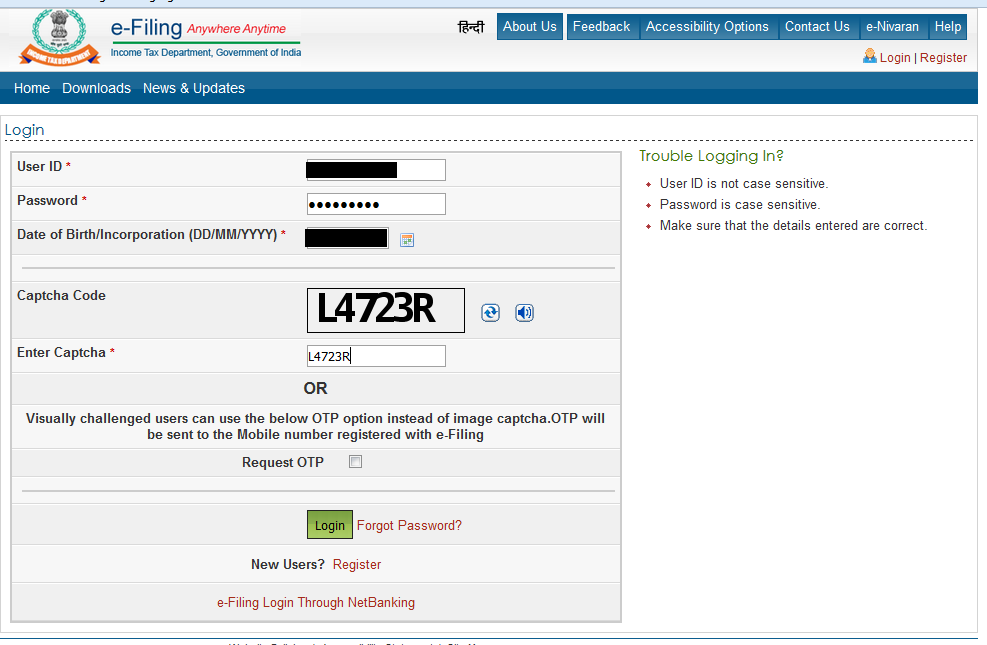

Step 1: Login 1 to income tax filing website https://www.incometaxindiaefiling.gov.in

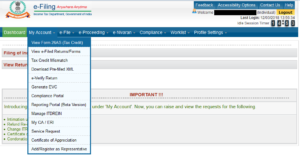

Step 2: Click on ‘My Account’ – View Form 26AS (Tax Credit)

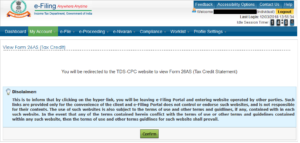

Step 3: Then you will be asked to confirm to go to the TDS-CPC website to view Form 26AS

Step 4: Next click on the link View Tax Credit (Form 26AS)

Step 5: Select the current assessment year and the format that you would like to see the Form 26AS in

Step 6: Then scroll down to section A of the (I have selected html format) and match the Tax deducted column details listed there with the tax details in your salary slip

2. View your Form 26AS online using the net-banking account of the following banks. You can View Tax Credit Statement (Form 26AS) only if your PAN number is mapped to that particular account.

In conclusion

Hope that your TDS details in Form 26AS match with the tax your company has deducted from your salary. In my next post I will explain how you can download/view your Form 26AS from two of the largest banks – SBI and ICICI.