It has a number of benefits over other small saving schemes:

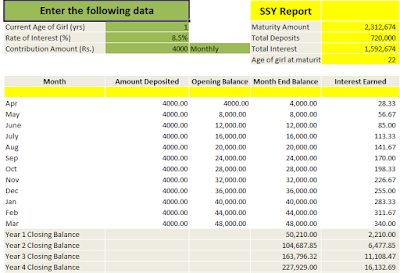

- The rate of interest is 8.5% per annum which is higher than most small savings schemes, only the EPF has a higher rate of interest at 8.75% per annum.

- The deposits made and interest earned is completely tax free in the hands of the beneficiary.

- An Indian citizen.

- Is aged 10 or less on day of opening account.

Only one account for each girl child can be opened; up to two such accounts can be opened by parents for two girls unless the second birth results in twin girls in which case a third account can be opened by a parent.

2. Where can the account be opened?

It can be opened in any public sector bank, government authorized bank or post office.

Given below is the list of banks which have been authorized to open and maintain Sukanya Samriddhi accounts:

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Oriental Bank of Commerce

- Punjab National Bank

- Punjab & Sind Bank

- State Bank of India

- State Bank of Patiala

- State Bank of Bikaner & Jaipur

- State Bank of Travancore

- State Bank of Hyderabad

- State Bank of Mysore

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

The account is transferable anywhere in India. The account is also transferable between post office and banks at minimal fee, done not more than once a year.

3. What are the documents required?

- Birth certificate of the child.

- Photograph of both child and parent/guardian.

- Address proof: Passport, Ration Card, Electricity Bill, Telephone Bill, Driving License, Aadhar.

- Guardian/Parent’s ID: PAN card, Ration card, Driving License, Passport, Aadhar.

4.How much money do you have to deposit?

- Minimum 1000/- and then multiples of 100 upto 1.5 lakh in a financial year can be deposited under the scheme.

- The deposit can be made lumpsum or staggered in any no of time deposit.

- The deposit can be made by cash/ DD/ net banking or ECS

- If minimum deposit is not done in a year the account will be deemed default on payment, in such case account can be revived by paying Rs. 50/- and depositing minimum balance. If the account is not operated till 15 years after date of opening , then all deposit including those before default date will earn interest rate equivalent to post office savings scheme, with only exception where the deposit was not made due death of guardian in which case the account will earn interest as regular SSY account.

5. How can one operate the account?

A passbook is generated at the time of account opening. It can be operated

- Upto 10 years by guardian/parent.

- After 10 years by child herself if she wishes so.

- Deposits under this scheme are to be made for the first 15 years from account opening date.

- After 15 years no deposit will be made however the account will accumulate interest for the next 6 years and matures on completion of 21 years.

- The interest rate is revised by the government every 3 months. The current rate of interest is 8.5%.

- The interest rate is compounded annually.

- Interest for a month is calculated on the lowest balance between close of 10th of the month and the end of the month.

8. The withdrawal

- 50% withdrawal is allowed on child passing 10th or attaining 18 years of age, whichever is earlier for purpose of higher study on production of fee slips or admission letter.

- Certain cases may be allowed to withdraw prematurely on compassionate grounds such as illness etc. with proper documentation and reasons in writing.

- Death of the account holder/ change in citizenship/marriage will close the account from date of such change of status.

- In any case the account cannot be closed before 5 years from date of opening. In extraordinary cases where it is unavoidable the account will only earn post office savings rate for the tenure.

- Maturity is at 21 completed years of account after which it ceases to earn interest.

- EEE

- The deposit is exempt upto 1.5 lakh under 80c.

- The maturity is tax exempt as is the interest earned during tenure.

Hello

I would be happy if you could keep updating the revised interest rates on SSY regularly, as declared by government

hi

where can i get ecs facility either in bank or post office. I want to deposit 2000/- rs per every month. i am unable to deposit money every month.

Hi

Unfortunately at this point in time there is ECS facility is not provided for SSA.

Thanks

Rahul

Wonderful initiative by our government to secure the future of our nations girl child. I hope maximum number of girls will benefit from this.